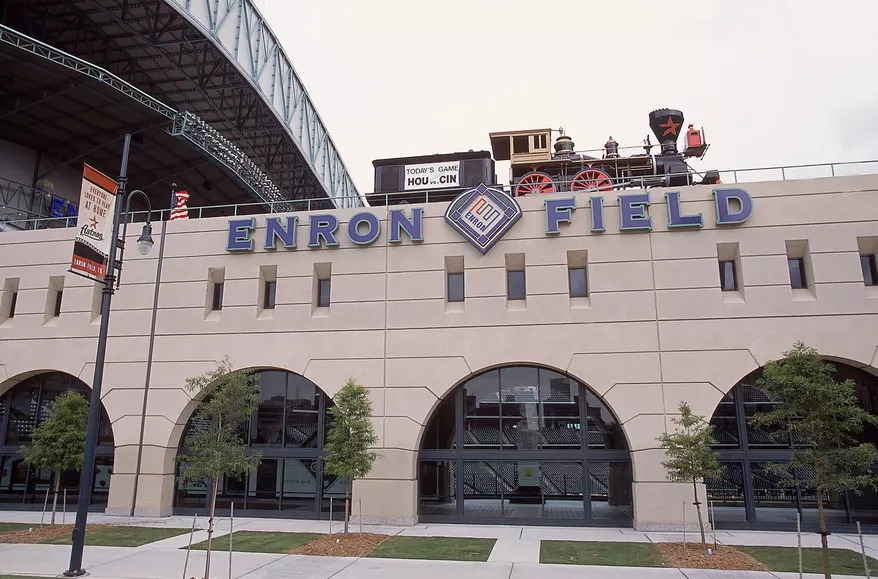

Enron Was the Future Too

Is NVIDIA an Astros fan? (Getty Images)

Enron was the golden child. By 2000, it was the seventh largest company in America, worth more than sixty billion dollars. The business magazines loved them. Wall Street analysts couldn’t say enough good things. Their executives walked around like rockstars.

The story was that Enron wasn’t just an energy company. They were “innovators.” They took long-term power contracts and turned them into Wall Street trading products. They even pitched themselves as the future of broadband and water. The stock hit ninety dollars a share. Employees loaded their retirement accounts with it. Everyone thought this was the next Exxon or GE.

But it wasn’t real. The profits were smoke. Enron used accounting tricks to book tomorrow’s profits as if they already happened. They hid billions of debt in shell companies so the books looked clean. On paper, it all looked great. In reality, they were building a house of cards.

Executives paid themselves bonuses for fake results. Employees believed the story and got left holding the bag. And the regulators? They weren’t watching close enough.

And let’s not pretend Washington had nothing to do with it. Deregulation in the 1990s gave Enron the platform to run wild. The company had friends in high places. Ken Lay — “Kenny Boy” — was close with the Bush family. At one point he was even mentioned as a possible Treasury Secretary. Campaign money flowed to both parties. Former government officials sat on their boards and cashed speaking checks.

When things started falling apart, Enron even lobbied the White House and Treasury for a bailout. They didn’t get it, but the fact they tried tells you how connected they were.

By the end of 2001, the game was over. The debt came to light. The stock crashed from ninety dollars to pennies. Enron filed for bankruptcy — the largest in U.S. history at the time.

Twenty thousand people lost their jobs. Retirement accounts were wiped out. Arthur Andersen, one of the biggest accounting firms in the world, collapsed with them for signing off on bad numbers.

And here’s the irony. When Enron was kicked out of the S&P 500, the company that took its place was NVIDIA. At the time, nobody cared — just another chip company.

Now look at today. NVIDIA isn’t just valuable; it’s the company propping up the stock market. Its chips are the backbone of the AI boom, and billions are being thrown at building data centers — or at least “supposedly” dedicated to it.

And here’s the twist — NVIDIA has even invested in Intel, one of its longtime rivals, to keep the AI machine humming. The whole setup feels familiar.

History doesn’t repeat, but it sure rhymes. Enron was untouchable until it wasn’t. Today it’s NVIDIA carrying the weight of Wall Street. The question is whether we’re seeing another story that looks unstoppable — until the music stops.