When Everyone Agrees, Slow Down.

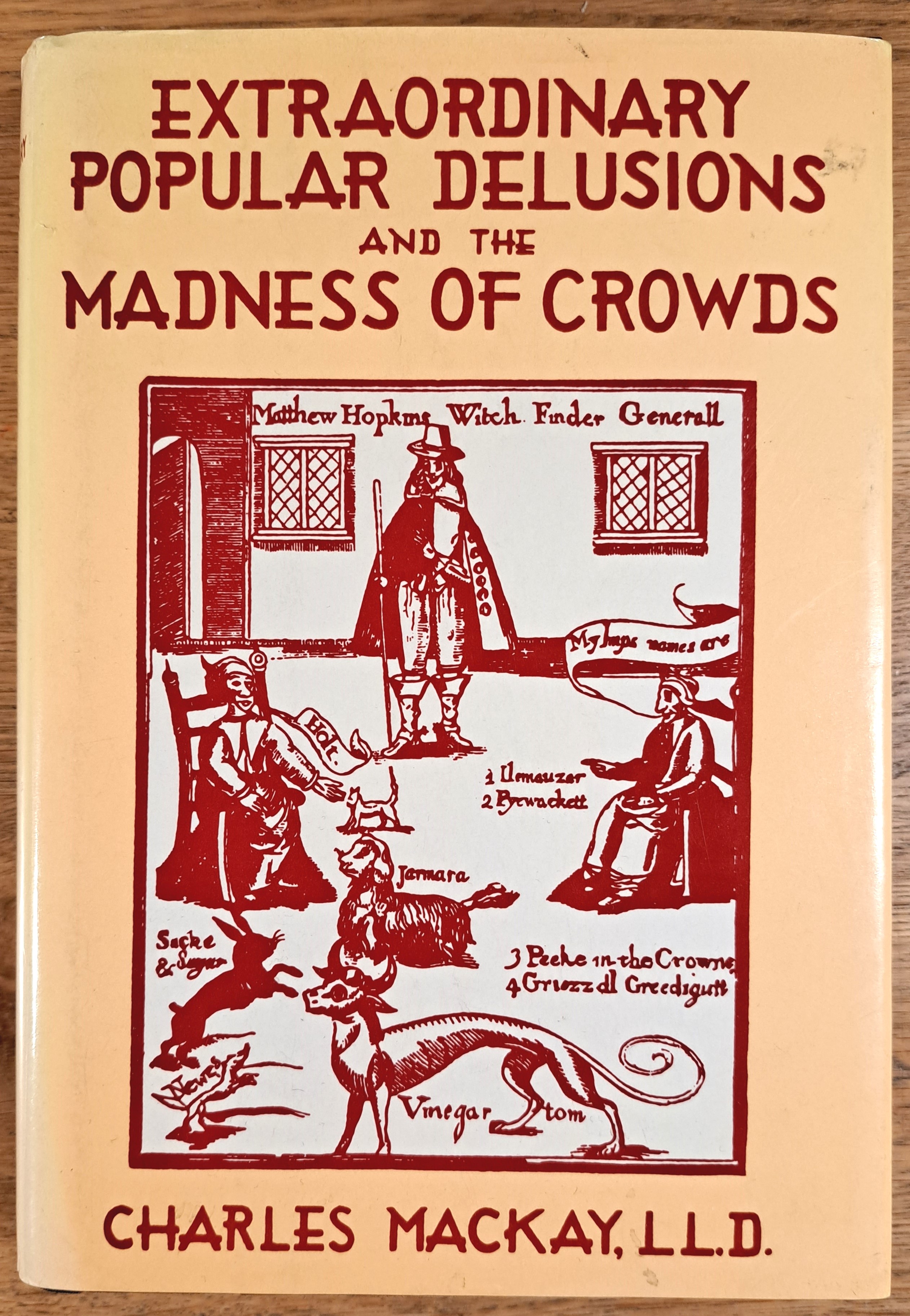

“Men, it has been well said, think in herds; it will be seen that they go mad in herds, while they only recover their senses slowly, and one by one.”

— Charles Mackay

A guy wrote that in 1841.

1841.

No internet.

No CNBC.

No Reddit.

No smartphones.

And somehow, he still perfectly described today.

Markets.

Politics.

Housing.

Crypto.

Even parts of the concrete industry.

Technology changes.

Human nature doesn’t.

We still rush in together.

And crawl out alone.

Here's a reminder.

Dot-com bubble (late 1990s)

Pets.com circa November 1999. Bet the farm. (Archive.org)

“The internet changes everything.”

Profits didn’t matter.

Revenue didn’t matter.

You just needed a website and a dream.

Companies with no product were worth billions.

People quit stable jobs to day trade tech stocks from their kitchen table.

Then reality showed up.

Nasdaq dropped almost 80%.

Suddenly everyone claimed it was “obvious.”

It wasn’t obvious.

They were just part of the herd.

Housing bubble (2003–2008)

You had me at Bank Owned. (LA Times)

“Housing never goes down nationally.”

That was the line.

So we handed out:

No-doc loans

Zero down

Adjustable rate time bombs

House flipping became a career path.

Taxi drivers owned five rentals.

Banks packaged garbage loans and stamped them “AAA.”

Then the music stopped.

Foreclosures everywhere.

Lehman gone.

Markets frozen.

And again… everyone suddenly became a genius in hindsight.

Same cycle.

Mad together.

Recover one by one.

Crypto & NFT mania (2020–2022)

All yours for just $63M. (Webopedia)

This one happened fast.

Stimulus checks.

Apps on your phone.

Zero commissions.

Everyone became a trader overnight.

Coins with dog logos.

JPEGs selling for half a million dollars.

People explaining “tokenomics” like they were venture capitalists.

I’m not saying the tech is useless.

But the mania was obvious.

When your barber and your cousin are both giving you crypto tips at Thanksgiving… you’re late.

Then 70–80% drawdowns.

Silence.

Same movie.

Different costumes.

Greenwashing & ESG capital rush (last decade)

Landfilling the unrecyclable wind turbine blades. Totally green. (Getty)

This one hits closer to home for our industry.

Suddenly everything had to be “net zero.”

“Low carbon.”

“Sustainable.”

Money flooded anything with the right buzzwords.

Didn’t matter if the math worked.

Didn’t matter if performance dropped.

Didn’t matter if costs went up.

If it sounded green, capital chased it.

Marketing over physics.

Narratives over engineering.

We see this in cement and concrete every day.

Policies and specs written by committees chasing headlines instead of performance.

Another herd.

Same psychology.

Notice the pattern?

Different century.

Different technology.

Same behavior.

A story spreads.

Everyone nods.

Money pours in.

No one wants to look stupid by questioning it.

So they don’t.

Until reality forces them to.

Then everyone quietly pretends they were skeptical the whole time.

They weren’t.

They were just comfortable.

Herds are comfortable...Independent thinking isn’t.

If you see these… slow down:

- If everyone “knows” it can’t fail

- If fundamentals stop mattering

- If prices detach from reality

- If critics are mocked instead of debated

- If regular people start acting like experts

- If you hear “this time is different”

You’re probably in a herd.

Another big one:

When questioning the idea feels socially risky...That’s a red flag.

Truth doesn’t need protection.

Only narratives do.

Herds feel good.

You feel smart.

Safe.

Validated.

Everyone around you agrees.

Independent thinking feels lonely....Awkward.

Sometimes you look stupid for a while.

But that’s usually where the better decisions live.

Mackay figured this out almost 200 years ago.

We didn’t outgrow it.

We just got A.I.

The crowd will always run.

Your job is to slow down.

Ask dumb questions.

Check the math.

And be willing to stand alone for a bit.

Because herds go mad fast.

Recovery happens slowly.

One by one.